real estate tax shelter act 1986

Abstract- he Tax Reform Act of 1986 has contributed to the decline of the real estate. A law passed by the United States Congress to simplify the income tax code.

The Top Tax Court Cases Of 2018 Who Qualifies As A Real Estate Professional

Before 1986 wealthy individuals could use passive income losses from a real estate tax shelter to offset active income.

. Tax Reform Act 1 of 1986 Richard A. The 1986 Tax Reform Act has made sweeping changed in the nations tax code. Real Estate Partnerships and the Looming Tax Shelter Threat article Many touted the tax reform legislation known as the TCJA as the most significant change to the Internal Revenue Code IRC since the Tax Reform Act of 1986.

All real estate losses are considered passive losses losses that are incurred through an enterprise which the investor is. Westin The Tax Reform Act 2 of 1986 PL. Regular rental and commercial activity will be slightly disfavored while historic and old rehabilitation activity will be greatly disfavored.

Changes in capital gain treatment depreciation limits on passive loss deductions limits on investment interest deductions and the extension of the at-risk. The 1986 Tax Reform Act has made sweeping changed in the nations tax code. Some of the benefits include lowering mortgage interests recovering the costs of an income-producing property via.

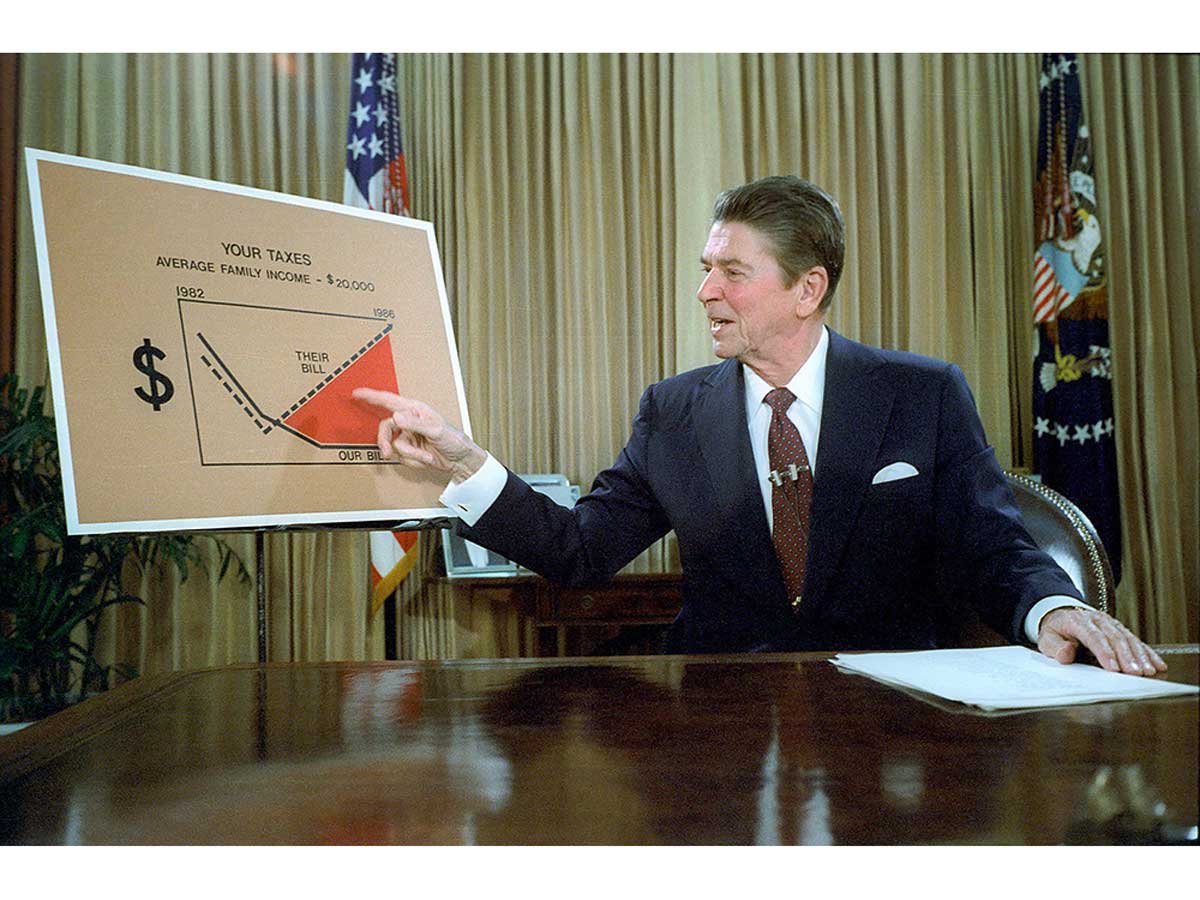

The Tax Reform Act of 1986 commonly referred to as the second of two Reagan tax cuts lowered. Investing in real property is a widespread tax shelter. Within the broad aggregate however widely different impacts are to be expected.

The 1986 act limited the deduction of. Unfortunately the Tax Reform Act of 1986 has limited this tax shelter. Tax Reform Act Of 1986.

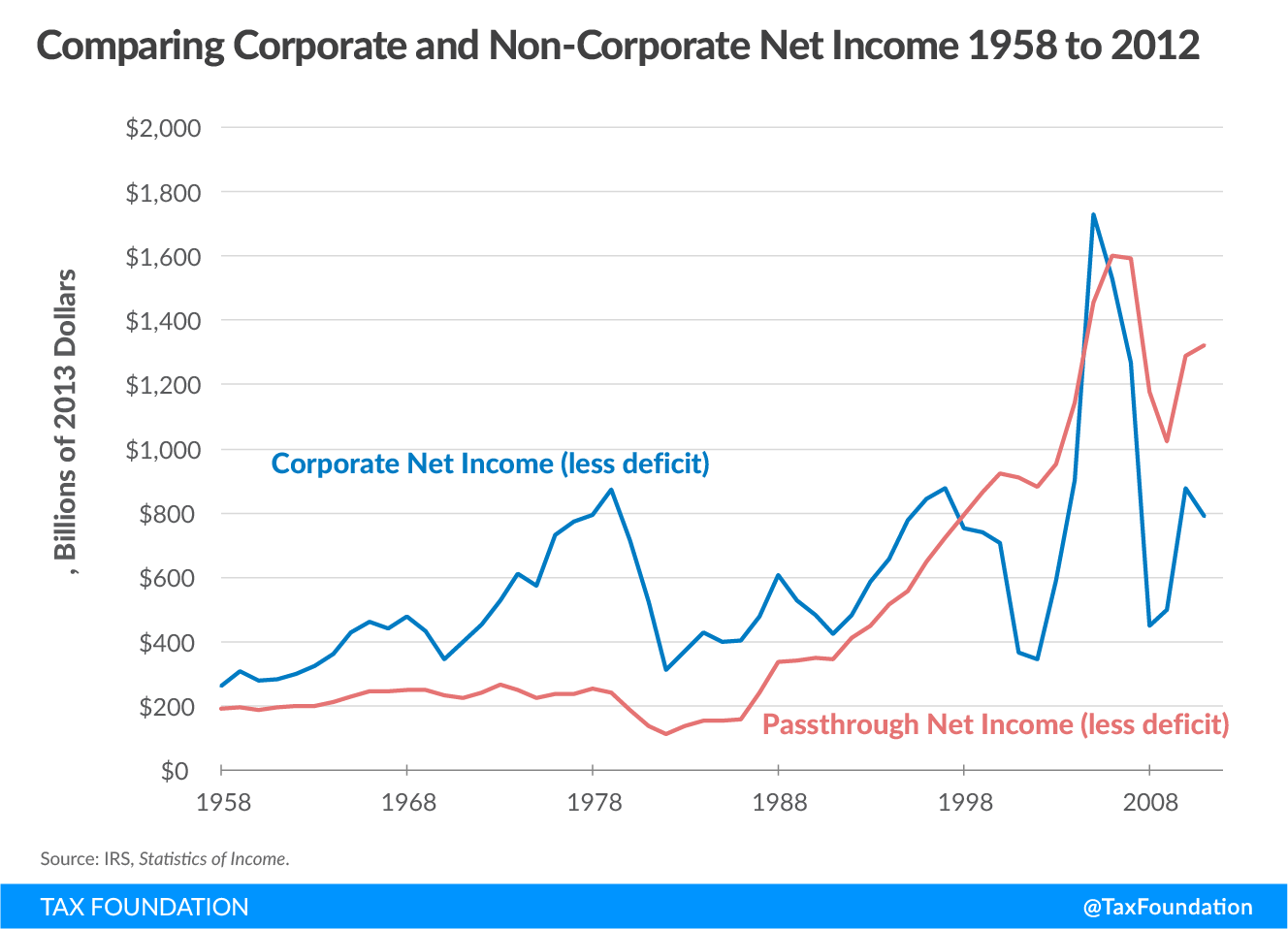

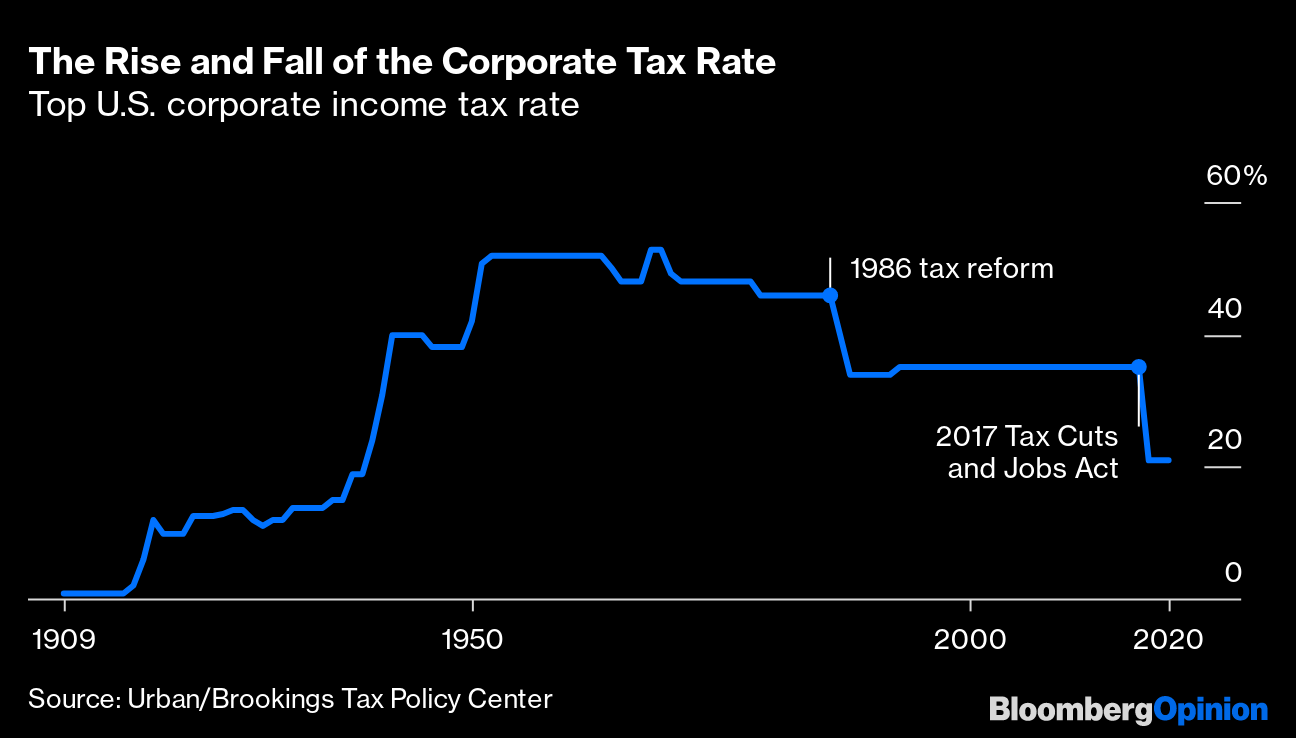

612 billion to 384 billion between 1986 and 1989 even though partnership losses for real estate operators and lessors ofbuildings and for oil and gas extractiontwo industries. The Tax Reform Act of 1986 was. While those reactions are most assuredly true the proclamations were made at a time when there was substantial.

While the Code has been totally revamped the investors of real estate seem to be the main target of the Act. Tax Reform Act of 1986 by Cordato Roy E. While the Code has been totally revamped the investors of real estate seem to be the main target of the Act.

Destroying real estate through the tax code. In contrast to the conventional wisdom real estate activity in the aggregate is not disfavored by the 1986 Tax Act. Within the broad aggregate however widely different impacts are to be.

In contrast to the conventional wisdom real estate activity in the aggregate is not disfavored by the 1986 Tax Act. 2085 implemented a tax code that at once swept away and reenacted its predecessor. While the Code has been totally revamped the investors of real estate seem to be the main target of the Act.

2085 enacted October 22 1986 to simplify the income tax code broaden the tax base and eliminate. The association meets monthly to address real property tax and assessment issues throughout New Jersey. Education and professional enrichment programs are developed implemented or.

The 1986 Tax Reform Act has made sweeping changed in the nations tax code. Congress passed the Tax Reform Act of 1986 TRA PubL. The Tax Reform Act of 1986 TRA was passed by the 99th United States Congress and signed into law by President Ronald Reagan on October 22 1986.

Real Estate Tax Benefits The Ultimate Guide

The Real Lesson Of 70 Percent Tax Rates On Entrepreneurial Income

How Luke Perry S Estate Maximized This Unique California Tax Shelter

Top Ten Estate Planning And Estate Tax Developments Of 2021 The American College Of Trust And Estate Counsel

Washington Complex Will With Credit Shelter Marital Trust For Large Estates Washington Credit Shelter Trust Us Legal Forms

Silicon Valley Residents Say State Death Tax Needs To Die

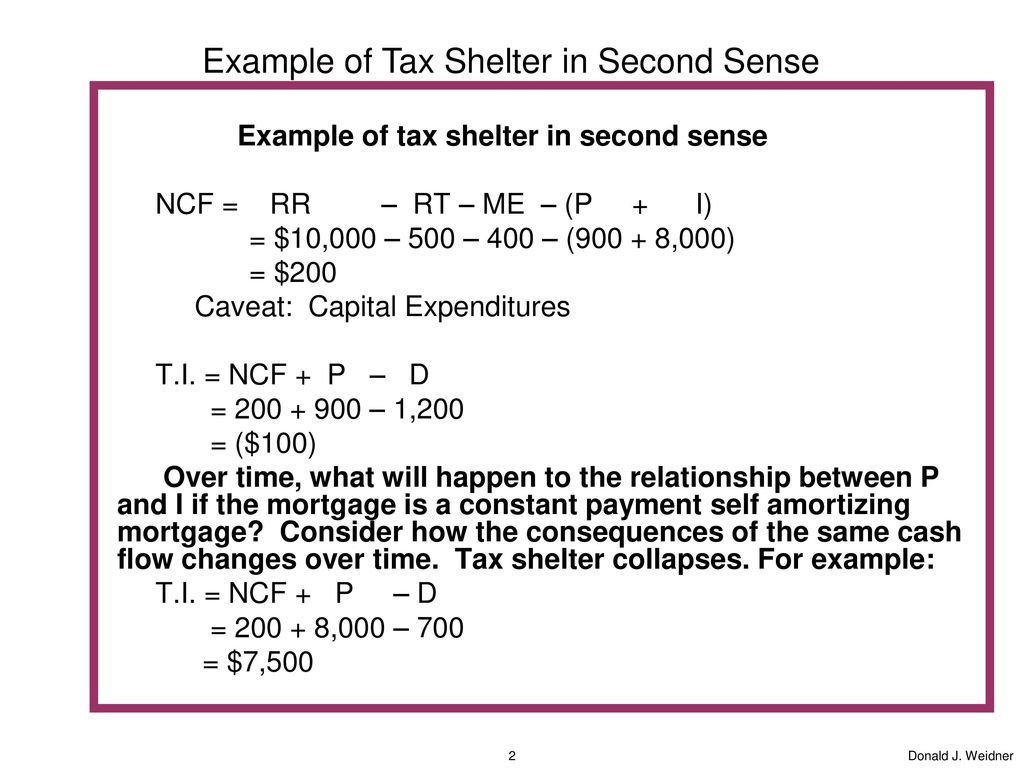

Introduction To Real Estate Tax Shelter Supplement Pages 53 55 Ppt Download

Reagans 1986 Tax Reform Act Lowered Taxes Simplified Reporting

Corporate Income Taxes Have Been Shrinking For Decades Bloomberg

Corporate Tax Avoidance In The First Year Of The Trump Tax Law Itep

California S New Prop 19 Property Transfer Law Spurs Flood Of Family Filings

How A Century Of Real Estate Tax Breaks Enriched Donald Trump The New York Times

Tax Guide Cpa For Real Estate Investors Real Estate Tax Accountant

Introduction To Real Estate Tax Shelter Supplement Pages 53 55 Ppt Download

Special Report 25 Years After Tax Reform What Comes Next

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Real Estate Taxes And Home Value Evidence From Tcja Sciencedirect

30 Years After The Tax Reform Act Still Aiming For A Better Tax System Journal Of Accountancy